2007年8月26日星期日

2007年7月13日星期五

US trade deficit up as price of oil rises

US trade deficit up as price of oil rises

This article talks about the US' trade deficit, which is the difference between imports and exports in the US' trade, is at the second highest level this year. This is due to the raise in oil prices and strong demand for Chinese products.

The reason that the US constantly has a high trade deficit may be because of a weak Chinese currency, which would make Chinese goods seem relatively cheaper. Chinese-made goods also have much lower costs compared to US-made goods, due to low labor costs. Also, oil has an inelastic demand, so when the price goes up, the quantity demanded wouldn't change much, therefore the total value of oil imported increases.

2007年7月11日星期三

EU aid to help developing countries jump on biofuel bandwagon

EU aid to help developing countries jump on biofuel bandwagon

The article talks about wealthy countries in Western Europe are giving aid to developing countries in Africa, for them to grow crops that can be used to produce biofuels.

I think this shows how trade can benefit both sides. The Western countries can benefit from having a new source of crops they can use to produce biofuels, therefore lowering the price of biofuels, and making them less dependent on fossil fuels. The African countries can have more employment and improve their own economy.

The article talks about wealthy countries in Western Europe are giving aid to developing countries in Africa, for them to grow crops that can be used to produce biofuels.

I think this shows how trade can benefit both sides. The Western countries can benefit from having a new source of crops they can use to produce biofuels, therefore lowering the price of biofuels, and making them less dependent on fossil fuels. The African countries can have more employment and improve their own economy.

2007年5月16日星期三

Energy costs push up US inflation

Energy costs push up US inflation

This article talks about the raising energy costs is increasing the US' inflation rate. When the costs of production in an economy goes up, the aggregate supply curve shifts in, since resource costs is a determinant of supply. When the aggregate supply curve shift in, with the aggregate demand curve staying the same, GDP would decrease and price level would increase. Since energy is essential in the production of almost all goods and services, it has a significant impact on the aggregate supply, therefore the inflation rate.

2007年5月14日星期一

Unit 3.3, Chapter 12 #7

7.

The full-employment budget measures the country's deficit or surplus if the economy reached the full-employment level of GDP with current Fiscal Policy policies. It is used to determine whether a government is engaging in expansionary or contractionary policy. A deflect or surplus in the actual budget when the full employment budget is balanced is a result of the economy not running at full employment.

If full employment was at GDP3, then there would be a full employment budget surplus. Even though the actual budget has no deficit at GDP2, the fiscal policy is contractionary. The government should cut taxes or increase spendings. The g line should be raised or the T line should be lowered so they intersect at GDP3.

The full-employment budget measures the country's deficit or surplus if the economy reached the full-employment level of GDP with current Fiscal Policy policies. It is used to determine whether a government is engaging in expansionary or contractionary policy. A deflect or surplus in the actual budget when the full employment budget is balanced is a result of the economy not running at full employment.

If full employment was at GDP3, then there would be a full employment budget surplus. Even though the actual budget has no deficit at GDP2, the fiscal policy is contractionary. The government should cut taxes or increase spendings. The g line should be raised or the T line should be lowered so they intersect at GDP3.

2007年5月10日星期四

Unit 3.3, Chapter 12 Key Questions #2, 3

2.

Multiplier

= 1/ MPS

= 5

government spending = $5 billion

.8 x Tax Cut = 5 Billion

Tax Cut = 6.25 Billion

1.25 billion is saved, not spent.

3.

Increase taxes, decrease government spending, or both. Aggregate demand shifts in, therefore inflation goes down.

Someone that thinks the public sector is too large would favor less government spending, someone that wants to preserve the size would raise taxes

Multiplier

= 1/ MPS

= 5

government spending = $5 billion

.8 x Tax Cut = 5 Billion

Tax Cut = 6.25 Billion

1.25 billion is saved, not spent.

3.

Increase taxes, decrease government spending, or both. Aggregate demand shifts in, therefore inflation goes down.

Someone that thinks the public sector is too large would favor less government spending, someone that wants to preserve the size would raise taxes

2007年5月6日星期日

Unit 3.3, Chapter 11, the Last Word

1. Weigh the two arguments regarding unemployment in Europe. Is unemployment high because of high because of high natural rates of unemployment or because of deficient aggregated demand?

The reason for Europe's high unemployment rate probably lies between the two arguments. It is probably true that the natural rate of unemployment of Europe, especially Western Europe, is among the highest in the world. This is because of their very generous social benefits and minimum wage, which gives employers very little incentive to employ, and people little incentive to look for jobs. Therefore, 7-11% unemployment could possibly already be full employment for Europe. The second argument could also hold partly true, high interest rates and other government monetary policies could have kept aggregate demand relatively low. These two factors combined gave Europe high unemployment rates.

The reason for Europe's high unemployment rate probably lies between the two arguments. It is probably true that the natural rate of unemployment of Europe, especially Western Europe, is among the highest in the world. This is because of their very generous social benefits and minimum wage, which gives employers very little incentive to employ, and people little incentive to look for jobs. Therefore, 7-11% unemployment could possibly already be full employment for Europe. The second argument could also hold partly true, high interest rates and other government monetary policies could have kept aggregate demand relatively low. These two factors combined gave Europe high unemployment rates.

2007年4月8日星期日

Why do we Neglect Leisure and Cheer for Divorce?

1. GDP measures all the market value of all final goods and services produced in a country within a given period, usually a year. It can be used to measure the wealthiness of a country, since the more a country produces per year per capita usually means the more wealth an average person has. However, GDP is not always a good way to measure the wellbeing of people in a country. It does not measure leisure time, unreported goods and services, environment, quality of the products, and the distribution of wealth.

2. Illegal goods and services are not reported in GDP. Therefore, countries that legalizes prostitution, gambling, and some types of drugs might seem to have an advantage than a country that makes them illegal when their GDP are compared. There are also a lot of external costs to these goods/services that are not counted.

3. In 1996, Armstrong contributed the most to the GDP of the US in his cancer treatment, but also the lowest level of individual welfare, because of his sickness. His individual welfare was probably the highest during 1999-2005, because he was healthy and won the Tour de France 6 times in a row. Income and output is not always directly proportional to happiness, because the more goods and services you consume does not mean the happier you are.

4. a) none

b) none

c) in

d) in

e) out

f) none

5. When people go shopping, enjoy vacations, or spends money in other forms during their leisure time, this would be included in the GDP. However, welfare achieved during leisure time without spending money would be very hard to measure.

2. Illegal goods and services are not reported in GDP. Therefore, countries that legalizes prostitution, gambling, and some types of drugs might seem to have an advantage than a country that makes them illegal when their GDP are compared. There are also a lot of external costs to these goods/services that are not counted.

3. In 1996, Armstrong contributed the most to the GDP of the US in his cancer treatment, but also the lowest level of individual welfare, because of his sickness. His individual welfare was probably the highest during 1999-2005, because he was healthy and won the Tour de France 6 times in a row. Income and output is not always directly proportional to happiness, because the more goods and services you consume does not mean the happier you are.

4. a) none

b) none

c) in

d) in

e) out

f) none

5. When people go shopping, enjoy vacations, or spends money in other forms during their leisure time, this would be included in the GDP. However, welfare achieved during leisure time without spending money would be very hard to measure.

2007年3月19日星期一

Hong Kong's Jobless Rate Probably Held at Lowest in Six Years

Hong Kong's Jobless Rate Probably Held at Lowest in Six Years

The article talks about Hong Kong's unemployment rate is the lowest in six years. This has fueled Hong Kong's economic growth, since low unemployment leads to higher wages and consumer spending. The unemployment rate is expected to continue dropping, as more firms are going to employ more workers before the end of the year.

The article talks about Hong Kong's unemployment rate is the lowest in six years. This has fueled Hong Kong's economic growth, since low unemployment leads to higher wages and consumer spending. The unemployment rate is expected to continue dropping, as more firms are going to employ more workers before the end of the year.

2007年3月7日星期三

Chinese premier pledges more support for education, health care

Chinese premier pledges more support for education, health care

The article talks about the Chinese government decides to increase their funding on subsidising health care and education. The article also talks about the government's increase funding in national defence.

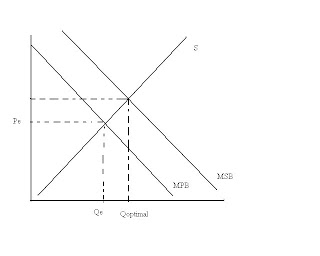

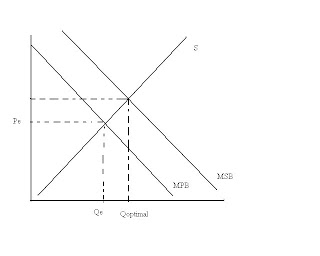

Education and health care are both merit goods. They will be provided to some extent by the free market, because there are always some private schools and hospitals. But because they give positive externalities, they are under allocated by the free market. This is because these merit goods provide society with more benefit than the private consumer, meaning that the marginal social benefit (MSB) is higher than the marginal private benefit (MPB). If more people in China gets educated, society as a whole would be better off than just the students themselves, because crime rates would drop, quality of labor would improve, and the educated population can also come up with new technology and ideas that can benefit society. Health care also has similar benefits to society, by improving the quality of labor, and preventing contagious diseases from spreading to others in society. If this good was left to the free market equilibrium, society as a whole would be inefficient.

The article talks about the Chinese government decides to increase their funding on subsidising health care and education. The article also talks about the government's increase funding in national defence.

Education and health care are both merit goods. They will be provided to some extent by the free market, because there are always some private schools and hospitals. But because they give positive externalities, they are under allocated by the free market. This is because these merit goods provide society with more benefit than the private consumer, meaning that the marginal social benefit (MSB) is higher than the marginal private benefit (MPB). If more people in China gets educated, society as a whole would be better off than just the students themselves, because crime rates would drop, quality of labor would improve, and the educated population can also come up with new technology and ideas that can benefit society. Health care also has similar benefits to society, by improving the quality of labor, and preventing contagious diseases from spreading to others in society. If this good was left to the free market equilibrium, society as a whole would be inefficient.

In the free market, the equilibrium quantity would be at Qe, because the marginal private benefit is not very high. However, counting in the positive externalities, the optimal quantity should be at Qoptimal. This is an market failure.

This market failure can be fixed with government intervention. The China government is attempting to fix this failure by subsidizing hospitals and schools in China, so more and more people can be educated and have access to health care. According to the article, 223.5 billion yuan of subsidies has been put into education, and 10.1 billion yuan has been put into health care. This is because the Chinese government sees that positive externalities of education and health care, seeing that "education is the bedrock of China's development." By giving subsidies, the supply curve moves from S to Ss, or demand moves from MPB to MSB, depending on whether the subsidies are given directly to consumers (e.g. scholarships) or to the schools and hospitals. Therefore the equilibrium quantity would be at Qoptimal.

Increased spendings on the military has also been mentioned in this article. National defense is an example of a public good. Public goods would not be provided at all by the free market, because these produces are no excludable and no rivalry in consumption. This means that there is no way to prevent people from consuming it, and one person consuming it does not prevent another from consuming it too. Therefore, there is no way for a firm to charge consumers for consuming the product. However, society can still benefit from these public goods, such as national defense, therefore, the government must provide them. The Chinese government pays for the People's Liberation Army with taxes collected from the people because society can still benefit from this public good. However, each individual would not be willing to pay for it, because you cannot exclude anyone from being protected by the army, and one person being protected does not prevent another person to be protected. The governments increase in spendings to modernize the national defense could provide all of its people with better protection, therefore benefiting society as a whole.

The article also mentions China's efforts to control pollution. The government has limited loans to highly polluting industries that consume large amounts of energy, and shut down "small thermal power plants and backward iron foundries and steel mills." High taxes are also imposed on industry and highly polluting industries. This is an example using corrective taxes to fix this market failure. There are external costs to polluting industries, because the pollution they create cause negative externalities, such as health risks to others in society. Therefore, the marginal social cost (MSC) is higher than the maginal private costs (MPC). At the market equilibrium, resources are over allocated to polluting industries, because society is not getting the most benefit. Therefore the government taxes these firms in order to fix this market failure and move the equilibrium to the optimum level.

To fix this market failure, taxes should be equal to the external costs. This can internalize the external costs, by making the producers and consumers of this market to pay for the social costs to this good. Therefore, the equilibrium quantity is moved from Qe to Qo, the optimum level in society.

I think that the method the Chinese government is attempting to fix the market failures of externalities is very effective. Because taxation and subsidizing are market based solutions, and the market is made up of profit-maximizing firms and utility-maximizing consumers, the market equilibrium should shift to the socially optimal level, where society as a whole is getting the most benefit.

This market failure can be fixed with government intervention. The China government is attempting to fix this failure by subsidizing hospitals and schools in China, so more and more people can be educated and have access to health care. According to the article, 223.5 billion yuan of subsidies has been put into education, and 10.1 billion yuan has been put into health care. This is because the Chinese government sees that positive externalities of education and health care, seeing that "education is the bedrock of China's development." By giving subsidies, the supply curve moves from S to Ss, or demand moves from MPB to MSB, depending on whether the subsidies are given directly to consumers (e.g. scholarships) or to the schools and hospitals. Therefore the equilibrium quantity would be at Qoptimal.

Increased spendings on the military has also been mentioned in this article. National defense is an example of a public good. Public goods would not be provided at all by the free market, because these produces are no excludable and no rivalry in consumption. This means that there is no way to prevent people from consuming it, and one person consuming it does not prevent another from consuming it too. Therefore, there is no way for a firm to charge consumers for consuming the product. However, society can still benefit from these public goods, such as national defense, therefore, the government must provide them. The Chinese government pays for the People's Liberation Army with taxes collected from the people because society can still benefit from this public good. However, each individual would not be willing to pay for it, because you cannot exclude anyone from being protected by the army, and one person being protected does not prevent another person to be protected. The governments increase in spendings to modernize the national defense could provide all of its people with better protection, therefore benefiting society as a whole.

The article also mentions China's efforts to control pollution. The government has limited loans to highly polluting industries that consume large amounts of energy, and shut down "small thermal power plants and backward iron foundries and steel mills." High taxes are also imposed on industry and highly polluting industries. This is an example using corrective taxes to fix this market failure. There are external costs to polluting industries, because the pollution they create cause negative externalities, such as health risks to others in society. Therefore, the marginal social cost (MSC) is higher than the maginal private costs (MPC). At the market equilibrium, resources are over allocated to polluting industries, because society is not getting the most benefit. Therefore the government taxes these firms in order to fix this market failure and move the equilibrium to the optimum level.

To fix this market failure, taxes should be equal to the external costs. This can internalize the external costs, by making the producers and consumers of this market to pay for the social costs to this good. Therefore, the equilibrium quantity is moved from Qe to Qo, the optimum level in society.

I think that the method the Chinese government is attempting to fix the market failures of externalities is very effective. Because taxation and subsidizing are market based solutions, and the market is made up of profit-maximizing firms and utility-maximizing consumers, the market equilibrium should shift to the socially optimal level, where society as a whole is getting the most benefit.

Automakers ask judge to dismiss global warming lawsuit

Source

This article talks about "six leading American and Japanese automakers asked a federal judge in San Francisco today to dismiss a public nuisance lawsuit filed against them by the state of California over global warming."

These automobile firms are being fined for creating external costs to the society, which the whole society would have to take care of. Cars emit greenhouse gases such as carbon dioxide, which causes the greenhouse effect in the atmosphere. These external costs includes harm to public health, frequent extreme hot weather, increased flooding, and cost line erosion.

These additional costs are not paid for directly by the firm, therefore firms do not take this cost into account. Therefore at the market equilibrium, resources for cars are over allocated. To fix this market failure, the government taxes and fines these firms to move their costs curves upward, in order to meet the marginal social costs curve. Firms are unwilling to pay for this, because it lowers their profits.

Fining them is a good way to fix this market failure, as long as the fines are at the right amount. If building cars that create a lot of pollution would lead to fines, firms, as profit maximizers, would try to make the most environmentally friendly cars, despite of higher costs. Society would be better off as a whole.

This article talks about "six leading American and Japanese automakers asked a federal judge in San Francisco today to dismiss a public nuisance lawsuit filed against them by the state of California over global warming."

These automobile firms are being fined for creating external costs to the society, which the whole society would have to take care of. Cars emit greenhouse gases such as carbon dioxide, which causes the greenhouse effect in the atmosphere. These external costs includes harm to public health, frequent extreme hot weather, increased flooding, and cost line erosion.

These additional costs are not paid for directly by the firm, therefore firms do not take this cost into account. Therefore at the market equilibrium, resources for cars are over allocated. To fix this market failure, the government taxes and fines these firms to move their costs curves upward, in order to meet the marginal social costs curve. Firms are unwilling to pay for this, because it lowers their profits.

Fining them is a good way to fix this market failure, as long as the fines are at the right amount. If building cars that create a lot of pollution would lead to fines, firms, as profit maximizers, would try to make the most environmentally friendly cars, despite of higher costs. Society would be better off as a whole.

订阅:

博文 (Atom)